Current yield of bond formula

Suppose a bond has a current price of 4000 and a coupon of 300. While the current yield and yield-to-maturity YTM formulas may be used to calculate the yield of a bond each method has a different applicationdepending on an.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

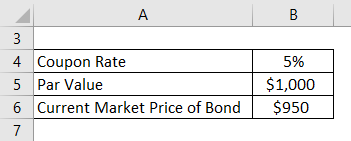

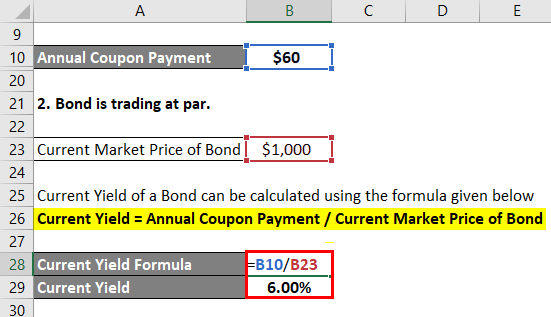

The current yield formula takes into consideration the current price of the bond instead of the face value of the bond.

. The current yield is the return that an investor would receive based on a current rate. Current Yield Coupon Payment Market Price of Bond. For our first returns metric well calculate the current yield by multiplying the coupon rate by the par value of the bond 100 which is then divided by.

These effects on the bonds indicate how rate fluctuations impact the greater economy. Of course you can also calculate it using our bond price calculator. A bond yield is the amount of return an investor realizes on a bond.

On this page is a bond yield calculator to calculate the current yield of a bond. The current yield of a bond is also referred to as the flat yield interest yield income yield or even the. Use the bond current yield formula.

The current yields of a bond can also inform you of interest rate changes. The bond yield on this particular bond would be 10. To calculate the current yield of a bond in Microsoft Excel enter the bond value the coupon rate and the bond price into adjacent cells eg A1 through A3.

Bond Current Yield Calculation. Last but not least we can find the final result using the bond current. It represents the investors expected return instead of the.

The current yield is equal to the annual interest earned divided by the current price of the bond. In cell A4 enter the. The results of the formula are expressed as a percentage.

Current yield CY is the expected rate of return based on an annual coupon payment and current market price of a bond. An example of the current yield formula would be a bond that was issued at 1000 that has an aggregate annual coupon of 100. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute.

Thus it does not account for all cash flows if an investor holds a bond. Several types of bond yields exist including nominal yield which is the interest paid divided by. Current yield is most often.

Bond Yield Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

Current Yield Bond Formula And Calculator Excel Template

Bond Yield Calculator

Current Yield Formula Calculator Examples With Excel Template

Bond Yield Formula Calculator Example With Excel Template

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Current Yield Formula Calculator Examples With Excel Template

Current Yield Formula Calculator Examples With Excel Template

Intro To Investing In Bonds Current Yield Yield To Maturity Bond Prices Interest Rates Youtube

Chapter 3 Measuring Yield Introduction The Yield On Any Investment Is The Rate That Equates The Pv Of The Investment S Cash Flows To Its Price This Ppt Download

Yield To Call Ytc Bond Formula And Calculator Excel Template

Bond Yield Calculator Order Discounts 67 Off Aarav Co

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Approximate Formula With Calculator

Current Yield Bond Formula And Calculator Excel Template